Worthwhile

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

A direct lender with a modern approach to reliability. We secure your data and support you in challenging conditions

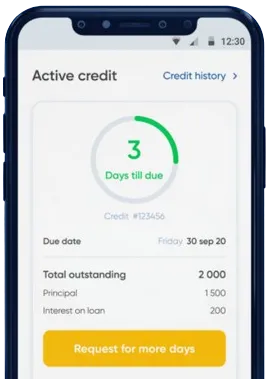

Seamless solutions in just 10 minutes from home. Instant money transfer and options to extend your loan

Initiate your application on our app by completing the required form.

Expect a decision in as little as 15 minutes.

Collect your money, with transactions often completed in one minute.

Initiate your application on our app by completing the required form.

Download loan app

When unexpected financial emergencies arise, many South Africans turn to same day payday loans to help them bridge the gap until their next payday. These short-term loans offer a quick and convenient solution for individuals who need cash fast. Here are some key benefits of same day payday loans in South Africa:

One of the main advantages of same day payday loans is the quick approval process. Unlike traditional bank loans that can take weeks to process, payday loans can be approved within a few hours or even minutes. This is particularly beneficial for those who need immediate access to funds.

Another advantage of same day payday loans is that they do not require a credit check. This means that individuals with poor credit scores or no credit history can still qualify for a loan. This is a significant benefit for many South Africans who may have been turned down by traditional lenders due to their credit history.

Payday loan lenders in South Africa focus more on the borrower's current financial situation and ability to repay the loan, rather than their credit score. This makes payday loans accessible to a wider range of individuals who may have been excluded from traditional lending options.

Same day payday loans in South Africa offer flexibility in loan amounts, allowing borrowers to borrow only what they need. This is particularly useful for those who only require a small amount of cash to cover unexpected expenses. Borrowers can choose the loan amount that best suits their needs, making payday loans a customizable financial solution.

Loan amounts for payday loans in South Africa typically range from R500 to R8000, depending on the lender and the borrower's income.

Individuals can borrow smaller amounts for short-term needs or larger amounts for more significant expenses, depending on their individual circumstances.

Payday loans in South Africa offer convenient repayment options that cater to the borrower's needs. Lenders typically offer flexible repayment terms, allowing borrowers to repay the loan in installments over a period that suits them best. This flexibility enables borrowers to manage their finances effectively and avoid defaulting on their loans.

Additionally, many payday loan lenders in South Africa offer online repayment options, making it easy for borrowers to make payments from anywhere at any time. This level of convenience ensures that borrowers can stay on top of their repayment schedule and avoid late fees or penalties.

Same day payday loans in South Africa provide a valuable financial solution for individuals facing unexpected expenses or financial emergencies. With quick approval processes, no credit checks, flexible loan amounts, and convenient repayment options, payday loans offer a practical and accessible way to access much-needed funds in times of need.

Same day payday loans are short-term loans that are typically granted and disbursed on the same day that you apply for them. These loans are designed to provide quick financial assistance to individuals who find themselves in need of immediate cash.

In South Africa, individuals can apply for same day payday loans online or in person at a lender's physical location. Once the application is approved, the funds are usually transferred directly to the borrower's bank account on the same day.

Typically, to qualify for a same day payday loan in South Africa, you must have a regular source of income, a valid ID, and a bank account. Lenders may also require proof of residency and a minimum age requirement.

The maximum loan amount for a same day payday loan in South Africa varies depending on the lender, but it is usually a relatively small sum compared to traditional loans. Lenders often cap the loan amount based on the borrower's income and repayment ability.

Interest rates for same day payday loans in South Africa tend to be higher than traditional loans due to the short-term nature of the borrowing and the perceived risk to the lender. It is important to carefully review the terms and conditions of the loan before agreeing to it.

Yes, individuals with bad credit can still apply for a same day payday loan in South Africa. Lenders who offer these loans typically focus more on the borrower's current financial situation and ability to repay the loan, rather than their past credit history.